The Corporate Sustainability Reporting Directive (CSRD) is a recent and significant development in sustainability reporting, designed to strengthen the existing requirements and enhance the comparability and reliability of corporate sustainability data. Introduced by the European Commission, the CSRD builds upon the foundation laid by the Non-Financial Reporting Directive (NFRD), expanding its scope and raising the bar for corporate transparency.

Corporate sustainability reporting has become a vital aspect of responsible business practices. As global challenges such as climate change, resource depletion, and social inequities continue to escalate, stakeholders are increasingly demanding greater transparency and accountability from companies in their environmental, social, and governance (ESG) performance. This growing emphasis on sustainability has led to the development of various reporting frameworks and guidelines that aim to standardize and improve the quality of sustainability disclosures.

The CSRD plays a crucial role in promoting sustainable business practices by establishing a comprehensive and robust reporting framework. By requiring companies to disclose relevant information on their ESG performance, risk management, and long-term strategy, the CSRD fosters a culture of accountability and enables investors, regulators, and other stakeholders to make more informed decisions. As businesses increasingly recognize the value of sustainability reporting and its potential to drive positive change, the CSRD will undoubtedly play a pivotal role in shaping the future of corporate sustainability and ESG disclosures.

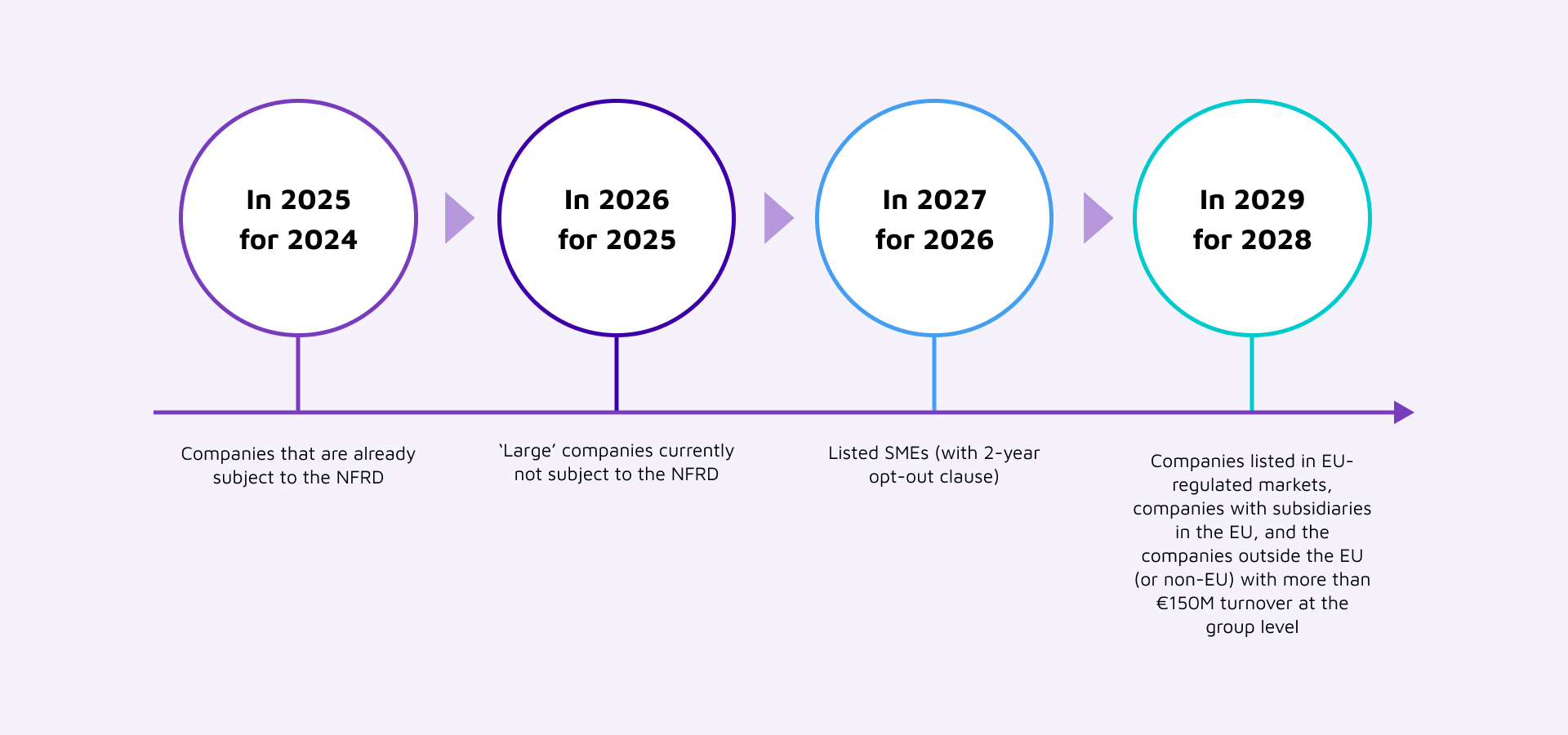

Figure 1. The CSRD’s reporting timeline from 2024 to 2029

An Overview of the CSRD

The Corporate Sustainability Reporting Directive (CSRD) is a regulatory framework introduced by the European Commission aimed at enhancing the transparency and comparability of corporate sustainability information. The primary purpose of the CSRD is to ensure that companies within its scope provide comprehensive, reliable, and relevant information on their ESG performance, allowing investors, regulators, and other stakeholders to make informed decisions and evaluate the sustainability of businesses.

The CSRD has evolved from the Non-Financial Reporting Directive (NFRD), which was initially adopted in 2014 as a step towards standardizing nonfinancial disclosures by large companies in the European Union. While the NFRD laid the foundation for sustainability reporting, it faced criticisms for the lack of consistency and comparability of reported data. The CSRD was developed to address these limitations by expanding the scope, refining the reporting requirements, and promoting greater alignment with international reporting standards.

The CSRD applies to a wide range of stakeholders, including large companies, publicly listed entities, and financial institutions within the EU. In addition to the companies that were already subject to the NFRD, the CSRD extends its applicability to all large companies and listed small and medium-sized enterprises (SMEs), excluding those listed on SME growth markets. As a result, the CSRD is expected to impact more than 50,000 companies across the EU. Furthermore, the CSRD requirements are not limited to EU-based businesses, as multinational companies operating within the EU are also expected to comply with these reporting standards.

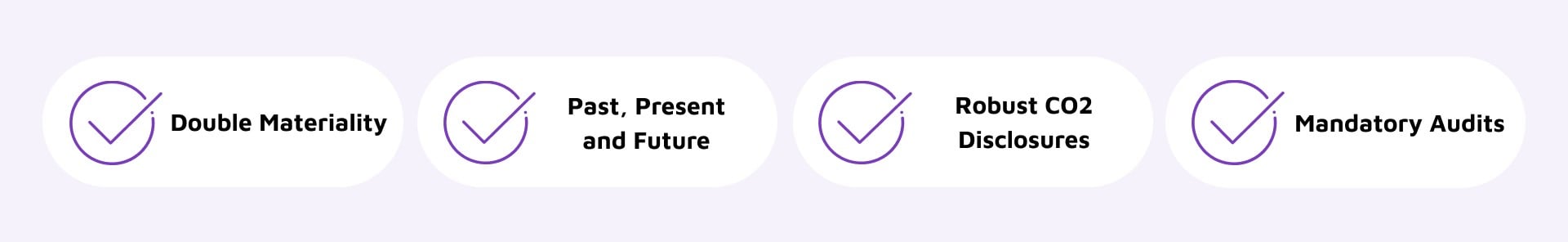

Figure 2. Some of the reporting requirements of the CSRD

Main components of the CSRD

The CSRD establishes a comprehensive set of reporting requirements that companies must adhere to in their sustainability disclosures. These requirements encompass a wide range of information, including the company's business model, policies, strategies, and performance related to ESG factors. Companies are also expected to report on their due diligence processes, risk assessment, and management practices, along with any adverse impacts of their activities on people and the environment.

Figure 3. ESG factors underscored in the CSRD

The CSRD emphasizes the need for companies to disclose information on ESG factors that are material to their operations. This includes, but is not limited to, climate change, biodiversity, water and waste management, human rights, labor practices, anticorruption measures, and diversity and inclusion.

Under the CSRD, companies are required to disclose information about their risk assessment and management processes, particularly in relation to ESG factors. This includes identifying potential risks, assessing their likelihood and potential impact, and implementing strategies to mitigate or manage these risks. By incorporating risk assessment and management into their reporting, companies demonstrate their commitment to proactively addressing ESG-related risks and enhancing their resilience.

To enable stakeholders to assess a company's progress on sustainability goals, the CSRD mandates the disclosure of relevant KPIs. These KPIs should be quantitative, measurable, and linked to the company's specific ESG objectives and targets. By reporting on KPIs, companies provide a clear and comparable picture of their sustainability performance, allowing stakeholders to track progress and make informed decisions.

The CSRD introduces assurance requirements to ensure the reliability and accuracy of the reported sustainability information. Companies must engage external auditors or assurance providers to verify their sustainability disclosures, which helps to enhance the credibility of the reported information and minimize the risk of greenwashing.

The CSRD seeks to align with and build upon existing sustainability reporting frameworks and standards, such as the Global Reporting Initiative (GRI), the Task Force on Climate-related Financial Disclosures (TCFD), and the Sustainability Accounting Standards Board (SASB). This alignment aims to streamline reporting requirements and minimize the reporting burden on companies, while promoting consistency and comparability of sustainability information across different jurisdictions.

What the CSRD means for businesses and stakeholders

Enhanced transparency and comparability of sustainability data: By establishing a standardized reporting framework and requiring companies to disclose material ESG information, the CSRD ensures that stakeholders have access to consistent and comparable data. This enhanced transparency allows investors, customers, and regulators to make more informed decisions and comparisons, leading to better capital allocation and increased support for companies with strong sustainability performance.

Improved risk management and decision-making: The CSRD encourages companies to adopt a more systematic approach to identifying, assessing, and managing ESG-related risks. By requiring companies to disclose their risk assessment and management processes, the CSRD promotes a proactive attitude towards addressing potential risks and mitigating adverse impacts. This improved risk management can lead to better decision-making and resource allocation within companies, ultimately contributing to increased resilience and long-term value creation.

Strengthened trust and reputation among investors, customers, and regulators:

By disclosing comprehensive and reliable sustainability information, companies demonstrate their commitment to transparency, accountability, and responsible business practices. This commitment can result in strengthened relationships with investors, customers, and regulators, leading to increased access to capital, improved customer loyalty, and a competitive advantage in the marketplace.

How the CSRD aligns with other directives

The CSRD is designed to complement and align with other existing legislations and reporting frameworks, both at the European and international levels. The main goal is to streamline reporting requirements, minimize the reporting burden on companies, and promote consistency and comparability of sustainability information across different jurisdictions.

Here’s how the CSRD aligns with European legislations and initiatives:

-

EU Taxonomy Regulation: The EU Taxonomy Regulation establishes a classification system for sustainable economic activities. By integrating taxonomy-related disclosures into the CSRD, companies can provide a clearer picture of their alignment with the EU's sustainability objectives and goals.

-

Sustainable Finance Disclosure Regulation (SFDR): The CSRD also complements the SFDR, which sets disclosure requirements for financial market participants and financial advisors concerning ESG risks and opportunities. The CSRD and the SFDR work together to improve the overall transparency of both corporate and financial sectors in terms of sustainability performance.

-

European Green Deal: The CSRD is a key component of the European Green Deal, which aims to make the EU carbon-neutral by 2050. By promoting comprehensive and transparent sustainability reporting, the CSRD supports the Green Deal’s objectives by enabling stakeholders to better assess and monitor the companies’ contributions to the EU’s sustainability goals.

Here’s how the CSRD complements international reporting frameworks and standards:

-

Global Reporting Initiative (GRI): The CSRD seeks to align with the GRI framework, which provides a widely recognized set of guidelines for sustainability reporting. This alignment helps in ensuring consistency in reporting practices and facilitates the integration of GRI guidelines into the companies’ CSRD disclosures.

-

Task Force on Climate-related Financial Disclosures (TCFD): The CSRD also aligns with TCFD recommendations, which provide a framework for companies to disclose climate-related financial risks and opportunities. By incorporating TCFD-aligned disclosures, the CSRD enhances the overall quality and relevance of climate-related reporting.

-

Sustainability Accounting Standards Board (SASB): The CSRD aims to build upon the SASB standards, which provide industry-specific sustainability disclosure guidelines. This alignment promotes consistency across industries and facilitates the integration of SASB guidelines into CSRD reporting.

Overall, the CSRD is designed to fit seamlessly with other legislations and reporting frameworks, promoting a more coherent and consistent approach to corporate sustainability reporting. By aligning with these various initiatives, the CSRD helps companies to meet multiple reporting requirements simultaneously and enhances the comparability and reliability of sustainability information for stakeholders.

Recommendations for complying with the CSRD

Companies require the following to comply and align sustainability initiatives with the CSRD:

Fully committing: The CSRD represents a significant enhancement compared with previous ESG reporting obligations. To meet these elevated expectations, your company must ensure active involvement from all stakeholders, particularly senior executives and board members. The CSRD demands more than just assembling a report. It requires a well-defined vision and setting clear goals.

Acting now: With a comprehensive understanding of the CSRD requirements, it’s crucial to make the appropriate decisions to guarantee that your organization complies with the directive.

Staying adaptable: As the reporting landscape evolves, it’s vital to evaluate the processes and tools supporting daily operations across the organization:

-

Do you have access to all the data your organization might need for reporting?

-

How is this data collected?

-

Is the data secure, verifiable, and interconnected?

Establishing these foundational elements (with the support of the right technology and processes) will enable organizations to handle any forthcoming reporting requirements.

How data and analytics helps with CSRD compliance

Data and analytics not only paves a solid foundation for companies to track the cost, performance, and impact of their sustainability initiatives. It also helps foresee future requirements and give their efforts more credibility and transparency:

-

Competitive advantage through actionable insights: Analytics can uncover hidden patterns and trends in ESG performance, providing valuable insights that can drive strategic decision-making. These insights can help the company stay ahead of the competition, improve its sustainability performance, demonstrate commitment to the CSRD, and attract socially responsible investors and customers.

-

Time and cost savings through automation: Implementing analytics-enabled tools can automate and streamline the data collection and reporting process, significantly reducing the time and resources required for CSRD compliance. By minimizing manual tasks and human errors, the company can allocate resources more efficiently and focus on strategic initiatives that contribute to its long-term sustainability goals.

-

Enhanced risk management and resilience: Predictive analytics and machine learning techniques can help in anticipating future risks, enabling the company to take preventive measures and adapt its strategies, thereby improving its reputation and appeal to investors, customers, and regulators.

-

Real-time tracking and more agile decision-making: Advanced analytics enable the company to monitor its ESG performance in real time, ensuring that it stays on track with its sustainability goals and CSRD requirements. This real-time visibility empowers the company to make agile, data-driven decisions and swiftly respond to emerging challenges and opportunities.

-

Benchmarks for continuous improvement and innovation: Analytics can help in benchmarking the company’s ESG performance against industry peers and best practices, revealing areas for improvement and potential opportunities for innovation. By leveraging these insights, your company can continuously enhance its sustainability reporting and implementation, positioning itself as a leader in the industry and demonstrating its commitment to the CSRD. This, in turn, can strengthen your company's brand value, attract investment, and foster customer loyalty.

Download our guide on regional and global sustainability regulations and standards that companies need to comply as well as well KPIs and success factors that can be integrated to track the performance and effectiveness of sustainability initiatives.

.png)