Revenue growth management (RGM) enables businesses to recalibrate and fine-tune their strategies for driving and enabling sales, attracting and retaining consumers, and anticipating ups and downs in the market. To successfully and sustainably implement RGM strategies, however, organizations need to lay a solid foundation — having the right kinds of data, the right technologies to consolidate them, and the holistic expertise to analyze them.

Today’s mounting inflationary pressures are compelling businesses to increase prices. Organizations are only starting to adapt to postpandemic paradigm shifts, but social upheavals, supply chain disruptions, and increasing prices in energy, raw materials, packaging, and freight transportation are testing the resilience and capability of businesses — particularly CPG and fast-moving consumer goods (FMCG) companies — to remain relevant among its consumers.

Global and regional inflation is placing tremendous pressure on retail trade and value chains — from manufacturers, growers, suppliers, and distributors to consumers — and there are no signs of it easing soon. As Figure 1 shows, consumer prices of some household staples have steadily increased in Europe, reaching as high as 18.4% for food and food-related products.

CPG and FMCG companies are tackling these by bumping up the prices of their products. Around 40% of CPG brands in the US, for instance, plan to increase their prices in the first half of 2023. Restaurants, fast-dining companies, and apparel brands already did in 2021 and 2022.

-1.png?width=989&height=525&name=MicrosoftTeams-image%20(28)-1.png)

Figure 1. A visualization of monthly harmonized indices of consumer prices data (annual rate of change)

An inflationary market compounded by today’s dynamic consumer behaviors

Inflation and disruptions are only parts of the bigger roadblock to revenue growth. Brands also understand that there are limits to increasing prices, as they can push consumers to switch loyalties. More than ever, consumers are changing shopping habits and behaviors to get more bang for their buck.

In the US, for instance, 74% of surveyed consumers are opting for less expensive brands while 35% of global consumers are opting to shop at stores with discounts. In 2022, 77% of surveyed consumers worldwide are now more cautious in their spending regardless of their financial situation. Health and wellness as well as social and environmental sustainability are also gaining significant traction among consumers, placing more premium on values, relationships, and social responsibility.

These volatilities are exacerbated by rising costs of raw materials, energy, and labor as well as disruptions and complexities in global supply chains, which can be especially challenging for manufacturers and retailers. A multinational CPG company, for instance, noted inflation and supply chain woes as main reasons for recovering only 75% of their gross margin despite increasing prices by up to 13.3%. Even F&B and apparel companies felt the brunt of shortages in raw materials such as aluminum used for packaging and cotton for their jeans.

The significance of analytics-enabled revenue growth management

These myriad of often convoluted and interlinked factors are two-edged. On one hand, companies can cash in on these paradigm shifts by adapting to their dynamics. On the other hand, businesses need a “single source of truth” that their RGM teams, the C-suite, investors, stakeholders, suppliers/vendors, and partners can easily understand. Arriving at this truth, however, requires investment in business and technical capabilities.

This is where RGM comes in. RGM comprises data-driven, analytics-enabled, and technology-supported methods, techniques, and tools for maximizing revenue and uncovering lucrative opportunities.

As Figure 2 shows, revenue growth management is not just about increasing prices. Businesses need to develop a consumer-centric strategy that can be continuously monitored and improved based on real-time or near-real-time data and shifts in the market. This helps set guidance on pricing, for example, which would then enable brands to streamline their product portfolio to minimize the risk of losing existing consumers and find ways to engage and entice those who are less invested. After all, consumers are now more discerning about what brands do and how they do it.

Figure 2. A visualization of the various internal and external challenges in implementing an RGM strategy

Data-driven and analytics-enabled RGM is built on a solid foundation of insights and capabilities that enable businesses to implement short- and long-term initiatives for driving growth. This approach helps decision-makers better understand the impact of inflation on consumer behaviors with more granularity.

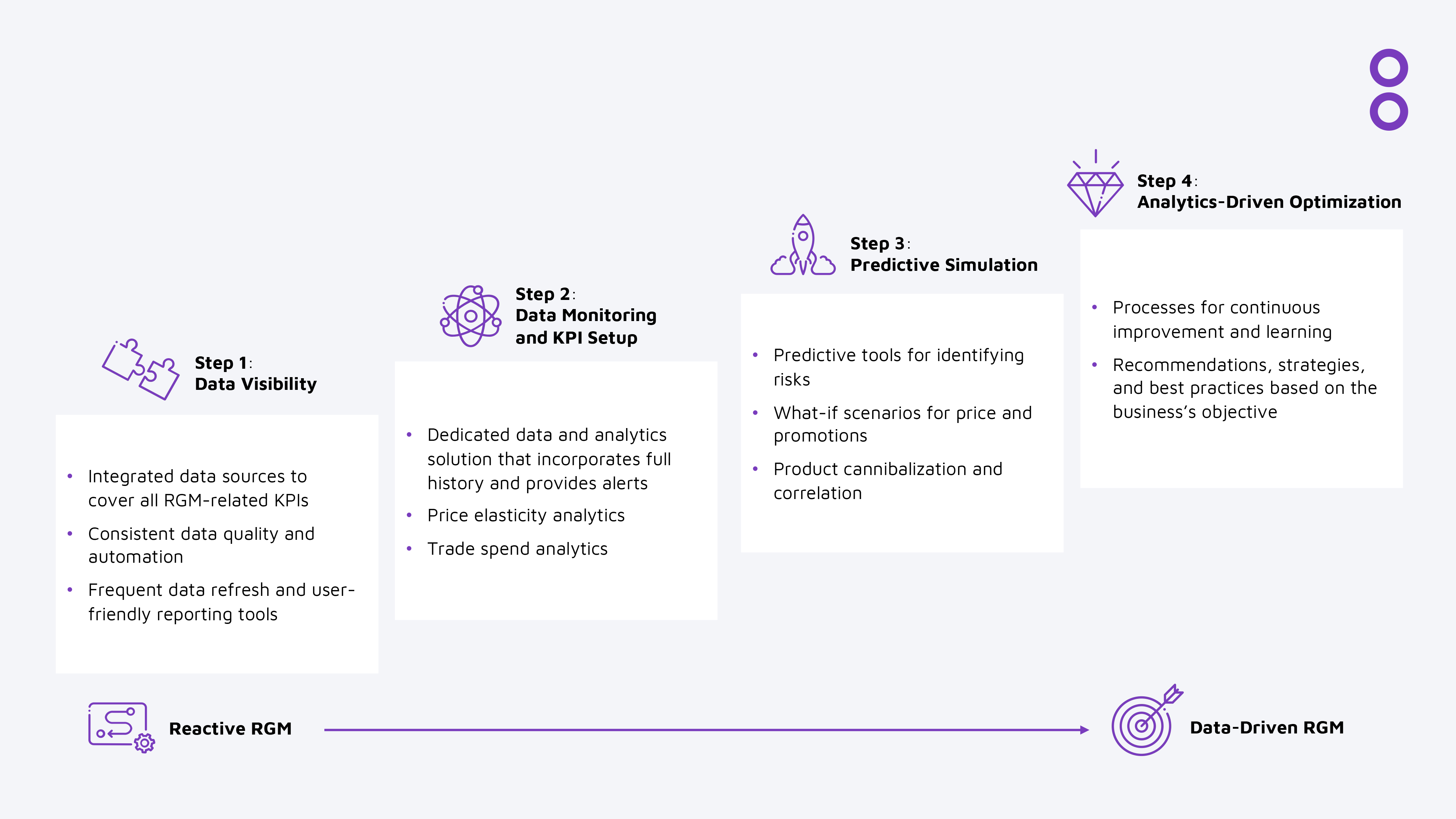

Figure 3. A four-step approach toward a data- and analytics-driven RGM strategy

As Figure 3 shows, the process is continuous. It shouldn’t be a one-off event or an initiative that can be left alone or run once a year. It’s iterative and long-term, with each step involving people who have the expertise and knowledge to achieve them. Companies that embed RGM across different business functions and invest in capability building are reportedly 2.4 times more likely to sustain value from it. Indeed, companies that implement RGM properly — with the right people with the right proficiency — can realize up to 7% gain in annualized gross margins even against an inflationary market.

Download our white paper, “Beyond Increasing Prices: Find Better, More Effective RGM Strategies via Analytics,” to learn about a holistic framework for managing and growing revenue, where data and analytics figures into the equation, and how a real-life multinational CPG company achieved a 7% year-over-year growth by incorporating advanced analytics in their RGM strategy.